Since we frequently deal with system selections and help companies to select and implement a business management system (ERP), it is always a question that both the client and we ask ourselves - which ERP system should we choose that is most suitable for their needs?

The choice depends on many things: how many and which processes you want to manage with a ERP, the specifics of the business, the investment opportunities, etc. One way is to draw up a short list of possible solutions that can be further analyzed, looking at what is used by competitors, neighbors or, more broadly, by Lithuanian companies and how they are assessed.

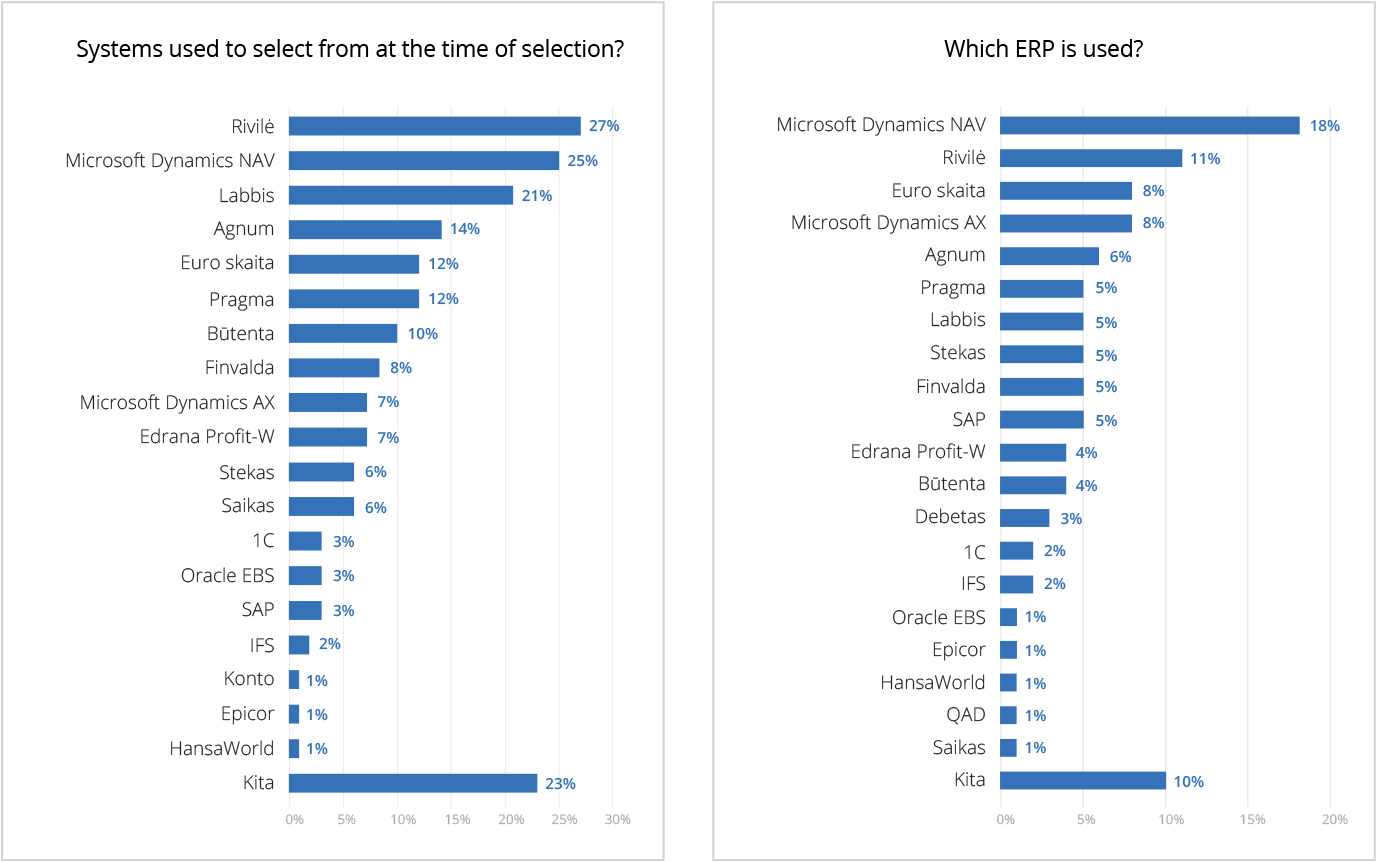

Exactly one year ago, we initiated the first independent quantitative study on financial accounting and business management systems utilized in Lithuania. Among the inquiries we aimed to address was determining the most prevalent and highly regarded ERP systems. Given that ERPs are more commonly adopted by larger enterprises, we focused on a sample of Lithuanian companies with an annual turnover exceeding EUR 5 million and a workforce exceeding 50 employees. From the nearly 200 responses collected, it was already possible to draw some conclusions. Admittedly, some of the results were unexpected.

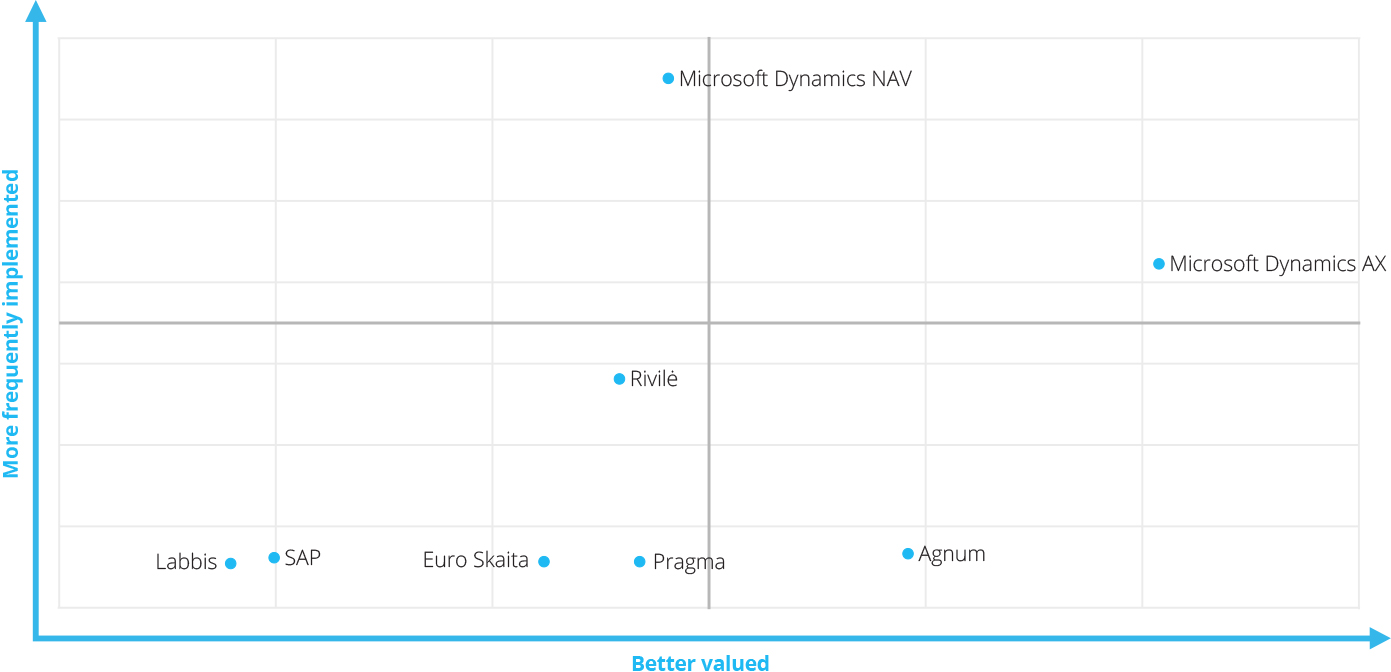

In Lithuania, Microsoft Dynamics NAV holds the position of market leader in terms of market share, while Rivilė secures its place in the leading quadrant both in terms of market share and system rating.

Financial and business management systems produced by Lithuanian manufacturers enjoy greater popularity than their foreign counterparts (constituting 59% of the market). Surprisingly, companies are more likely to consider Lithuanian ERP systems rather than opt for their implementation. In terms of functionality and other features, the leading positions have changed, with Agnum, Microsoft Dynamics AX, Rivilė, Stekas and SAP being the most highly rated systems.

Based on market share (number of implementations) and rating (functionality and other features), a quadrant of the most popular systems has been formed. The leader is Rivilė. Microsoft Dynamics AX, Euro Skaitai and Agnum would need to increase the number of implementations and Microsoft Dynamics NAV would need to increase user satisfaction to be among the leaders.

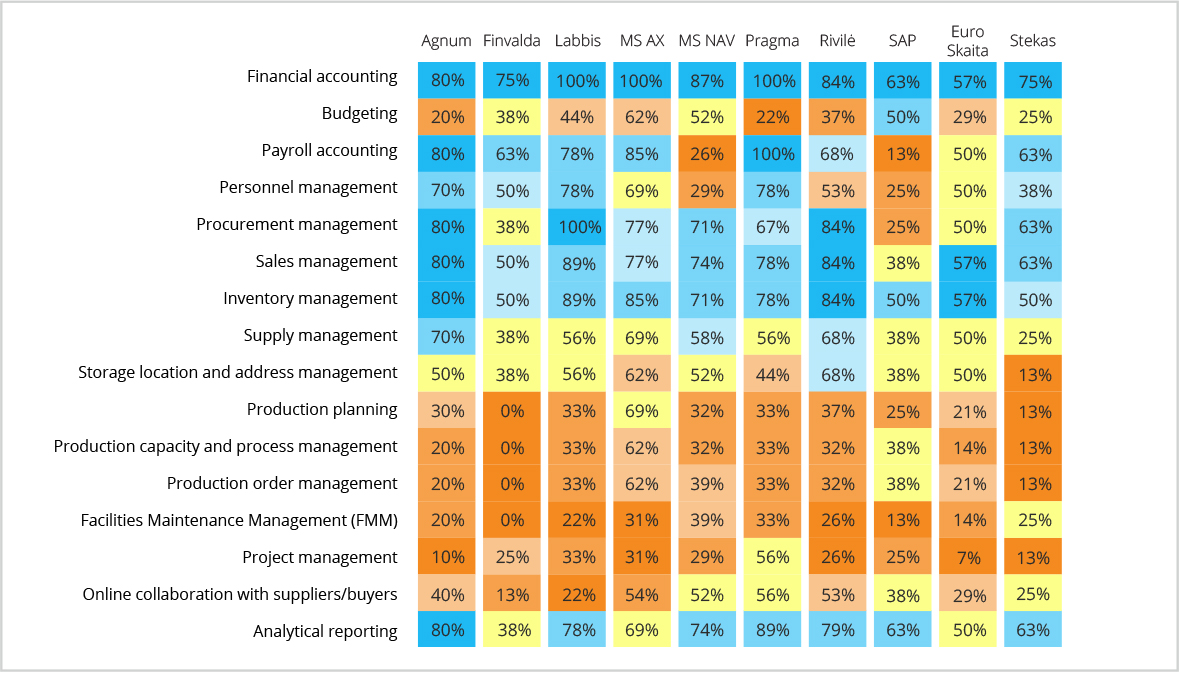

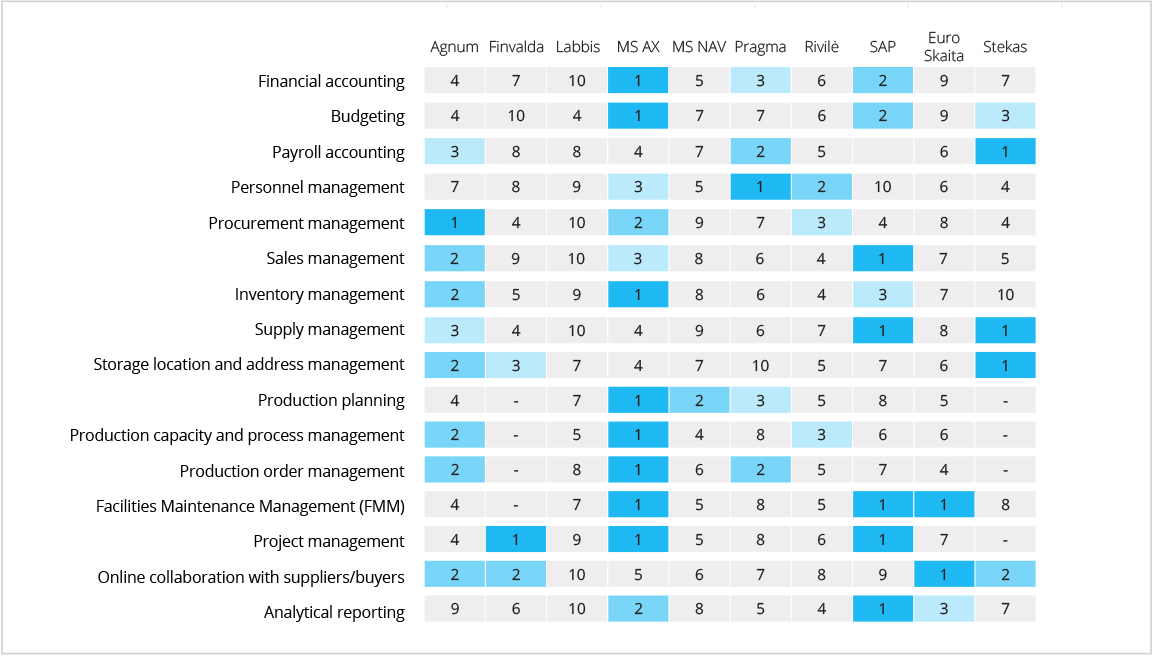

- Financial accounting functionality is employed by all companies across all systems.

- Budgeting functionality is mainly used in Microsoft Dynamics AX, Microsoft Dynamics NAV and SAP.

- Payroll accounting functionality is mainly used in Pragma, Microsoft Dynamics AX, Agnum, Labbis, Rivilė, Finvalda, Stekas systems.

- Personnel management functionality is mainly used in Labbis, Pragma, Agnum, Microsoft Dynamics AX, Rivilė systems.

- Procurement management functionality is incorporated in nearly all systems, with notable emphasis in Labbis, Rivilė, Agnum, Microsoft Dynamics AX, Microsoft Dynamics NAV, Pragma, and Stekas systems.

- Sales management functionality is integrated into nearly all systems, particularly prominent in Labbis, Rivilė, Agnum, Pragma, Microsoft Dynamics AX, Microsoft Dynamics NAV, Stekas, and Euro Skaita systems.

- Inventory management functionality is used in nearly all systems, with significant prominence in Labbis, Microsoft Dynamics AX, Rivilė, Agnum, Pragma, Microsoft Dynamics, and Euro Skaita.

- Supply management functionality is mainly used in Agnum, Microsoft Dynamics AX, Rivilė, Microsoft Dynamics NAV, Labbis, Pragma systems.

- Storage location and address management functionality is mainly used in Rivilė, Microsoft Dynamics AX, Labbis and Microsoft Dynamics NAV systems.

- Production planning, ordering, capacity and resource management functionality is mainly used in Microsoft Dynamics AX.

- Facilities Maintenance Management (FMM) functionality is used by a minority of companies and is more commonly used in Microsoft Dynamics NAV.

- Project management functionality is not widely used and is more common in Pragma.

- Functionality for online collaboration with suppliers/buyers is predominantly employed within Pragma, Microsoft Dynamics AX, Rivilė, and Microsoft Dynamics NAV systems.

- Analytical reporting functionality is present in all systems, though to a lesser extent in Finvalda.

The data provided below illustrates the percentage of system users utilizing different functional areas of the ERP.

What functional areas does the system use?

Survey respondents indicated their perceptions of the functional areas of the VMS they use. Below are the rankings of the systems.

Where does the system rank in terms of functional areas?

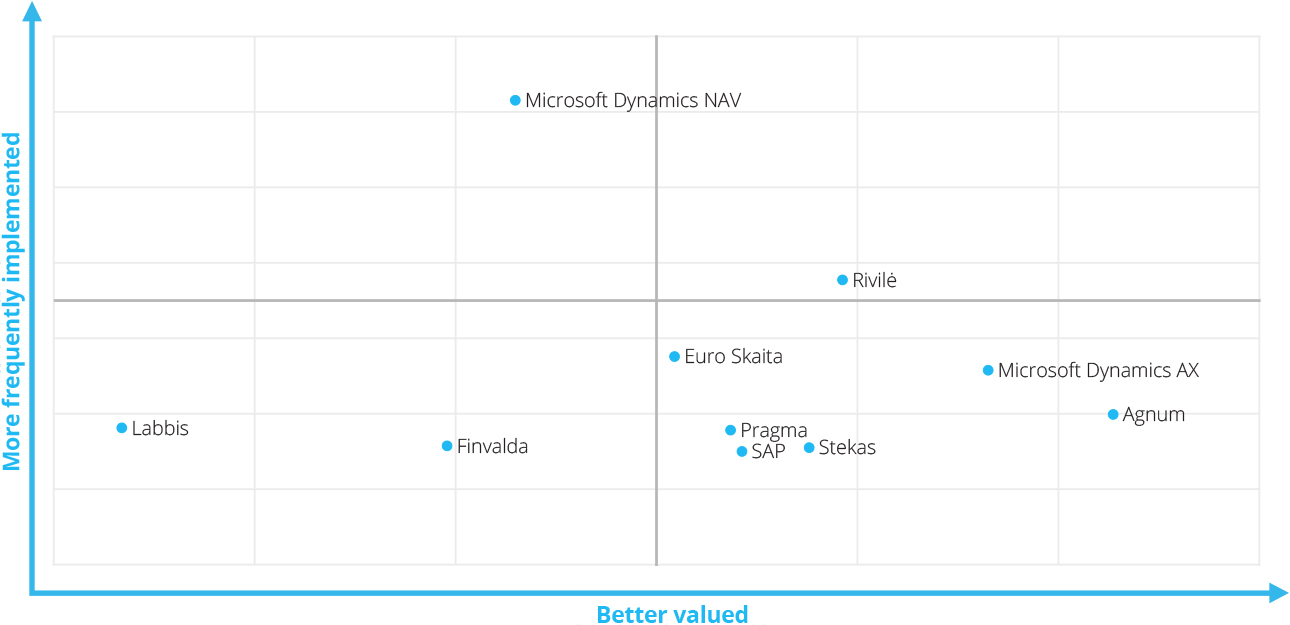

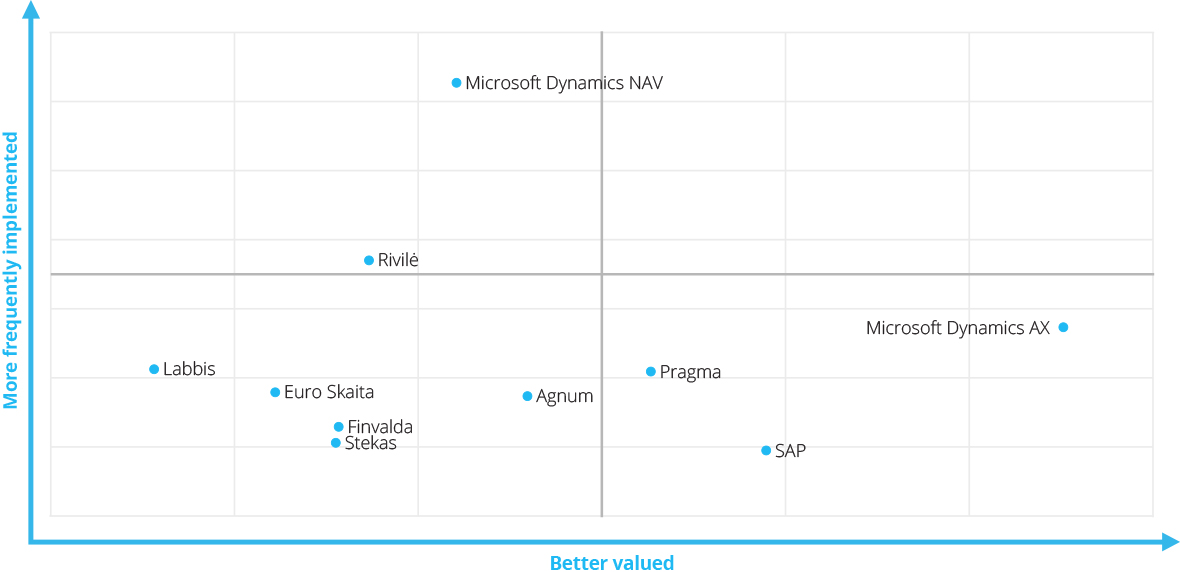

Finally, there are separate quadrants by market share (in terms of number of implementations) and by functional group.

In terms of market share and financial management functionality, Microsoft Dynamics AX, Microsoft Dynamics NAV and Pragma have the best positions in the systems quadrant.

Assessment of the system in terms of market share and financial functionality

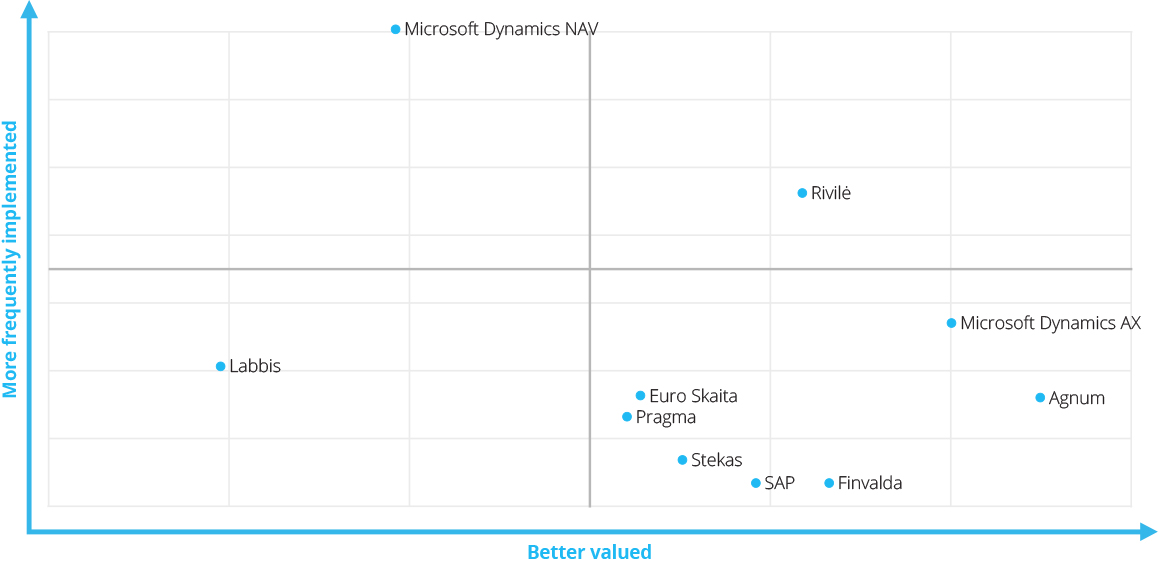

When considering market share and supply chain management functionality (which includes procurement, inventory, supply, warehousing, and address management functional areas), Rivila emerges as the leader in this quadrant of systems. However, for Microsoft Dynamics AX, Euro Skaitai, and Agnum to secure leadership positions, they should focus on increasing the number of deployments. On the other hand, Microsoft Dynamics NAV needs to enhance user satisfaction to join the ranks of leaders.

Evaluation of the system in terms of market share and supply chain functionality

In terms of market share and sales functionality, Rivilė is the leader in the systems quadrant. Microsoft Dynamics AX would need to increase the number of implementations and Microsoft Dynamics NAV would need to increase user satisfaction to be among the leaders.

Evaluation of the system in terms of market share and sales functionality

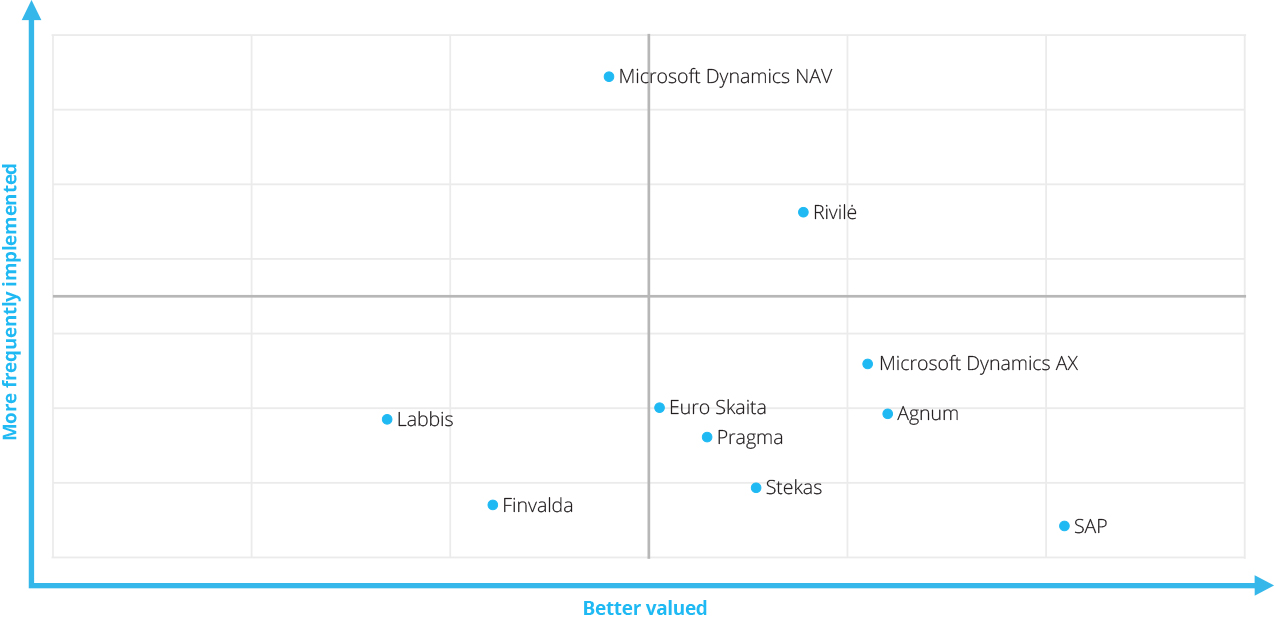

In terms of market share and evaluation of production management functionality (combining the functional areas of production planning, capacity and resource management, and production order management), Microsoft Dynamics AX is the leader in this quadrant of systems. Microsoft Dynamics NAV would need to improve user satisfaction in order to be among the leaders.

Evaluation of the system in terms of market share and production management functionality